In 2012, Bristol launched the UK’s most ambitious local currency experiment: the Bristol Pound. The initiative drew international attention, with TV crews from as far afield as Russia, China, Belize, and Singapore descending on the city to interview the organisers and report on this bold new idea.

The goal of the Bristol Pound was simple and compelling – to keep money circulating within the local economy. The theory went that if people could be persuaded to spend in independent shops rather than national chains, then the multiplier effect would boost local prosperity.

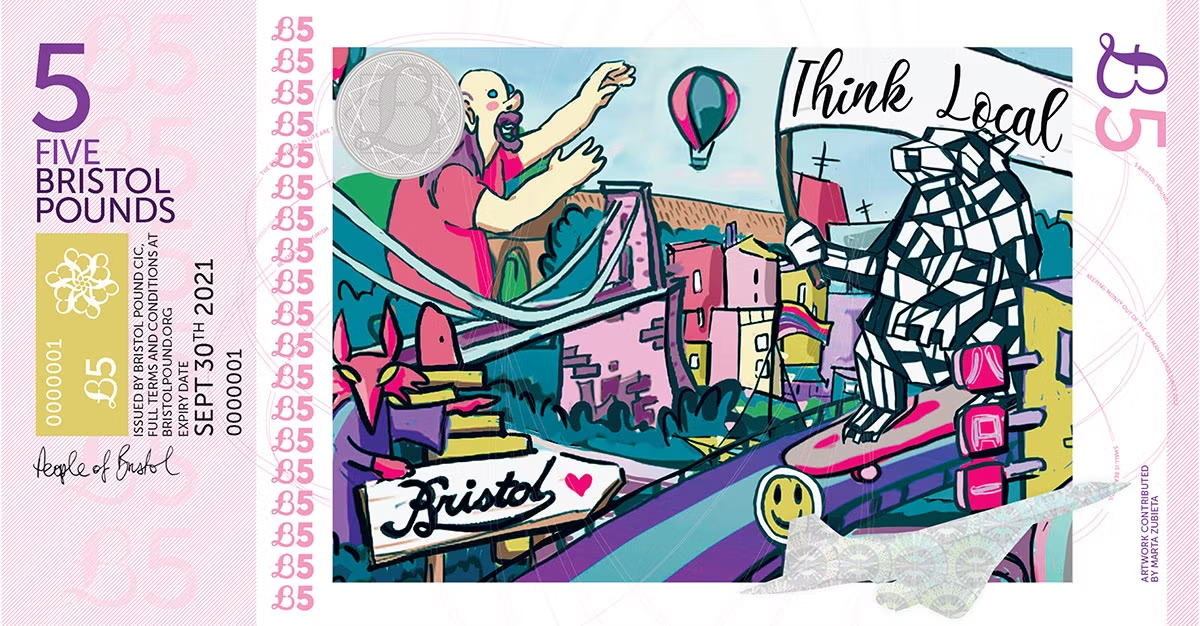

The Bristol Pound notes were a love letter to the city. Designed by local people through a city-wide competition, the winning entries ranged from bright hot-air balloons to iconic city figures like Concorde, graffiti tigers, and even the divisive moral reformer, Hannah More.

But what set the currency apart was its digital component. Unlike earlier local currencies such as the Totnes or Lewes Pounds, it wasn’t just a paper novelty. It was backed by the Bristol Credit Union, giving it serious financial credibility. And it offered SMS-based payments, a cutting-edge technology at a time when contactless cards and mobile wallets had yet to go mainstream.

The initial response from Bristol retailers was enthusiastic, with hundreds of independent businesses signing up to accept the currency. Some got creative with it, offering discounts to customers paying in Bristol Pounds. The city’s own mayor insisted that his salary be paid in it.

For residents, it was a talking point, a gesture of solidarity, and a badge of belonging.

And for a few years, it worked. The Bristol Pound became a symbol of the city’s independent spirit. It was lauded in international media, The Guardian hailing it for “giving sterling a run for its money” and the New York Times calling it “serious and credible”. When Bristol was named European Green capital in 2015, the Bristol Pound quietly gave itself a pat on the back.

Although the Bristol Pound wasn’t the first local currency in UK, it became the most successful. At its peak, there were 800 businesses accepting the currency, and five million Bristol Pounds spent cumulatively. It wasn’t long before similar schemes started appearing in other parts of the country, including Liverpool, Exeter and Lake Districts.

Beginning of the end

The problems started with scale. Although more than 1,000 local residents used it in the early years, that momentum plateaued. The actual volume of currency circulating never reached a point where it could support a self-sustaining ecosystem. Major suppliers, wholesalers, and utilities did not accept it, which meant that Bristol Pounds always had to be converted back into sterling at some point.

This created a psychological ceiling on adoption. Businesses had to deposit their earnings back into traditional banks to cover costs, and customers didn’t see the point of the extra step when most shops accepted cards and contactless payments.

One local business owner remarked “I agreed to accept it, of course, but I found it really quite complicated. There was this phone thing, and I had to open an account, and it wasn’t the easiest. I don’t actively encourage it”

Over time, Bristol Pound notes became more of a novelty for collectors and tourists, bought from the Tourist Information Office but rarely spent. According to Diana Finch, the former managing director of the Bristol Pound, “Too much of the currency is ending up behind a magnet stuck to a fridge or in a holiday scrapbook.”

The digital payments via SMS, once a unique selling point, became the scheme’s Achilles heel. The infrastructure was innovative but dated poorly. As Apple Pay, Google Wallet, and app-based banking exploded, SMS payments that could take up to ten minutes felt cumbersome and outdated.

Another challenge was the lack of incentive. Apart from the occasional discount, there was rarely a financial reason for people to use the currency. Users were expected to switch currency as a gesture of civic pride rather than for reward or convenience.

And while businesses were supportive in principle, the administrative burden of handling a parallel currency wasn’t worth the marginal benefit. With few customers using it, and no bulk purchasing options, most participants quietly opted out over time.

Despite efforts to sustain the project, the Bristol Pound was withdrawn from circulation in September 2020.

Lessons of history

History is full of great ideas that arrive before their time. Concepts that seem futuristic ultimately stall because the technology isn’t ready. Indeed, many innovations we think of as modern were actually conceived decades ago, waiting patiently for the right infrastructure, computing power, or cultural moment to catch up.

Take video calling. While we tend to associate it with the pandemic, the idea dates back much further. Believe it or not, AT&T’s Picturephone debuted at the 1964 World’s Fair and even went on sale to the public in 1970. But with bulky hardware, poor image compression, and astronomical costs, the idea sat idle on the shelf for over 30 years.

Electric cars tell a similar story, with General Motors, Citroen and Peugeot releasing early EVs since the 1990’s. However, without sufficient battery capacity or charging networks, they were more symbolic than practical.

Even social media had its false starts. Platforms like Makeoutclub and Six Degrees had lofty aspirations, but without fast internet, intuitive design, or scalable infrastructure, their user experience was never going to match what Facebook eventually delivered.

Local currency fits this pattern. A visionary concept in reimagining how money could serve a place, rather than simply pass through it. But no amount of ambition could overcome the technological limitations of the time, particularly in the area of mobile payments.

Today, those barriers have been lowered. Digital payment systems are now faster, more secure, and widely adopted, opening the door for local currencies to function with the same ease and trust as national currencies and market-leading payment providers.

Meanwhile, the principles that underpinned the Bristol Pound – supporting local economies, building community resilience, and reducing carbon footprints – have only become more urgent. As towns and cities search for new ways to keep their local economies ticking over, the idea of a local currency feels more timely than ever.

Like most good ideas, it will come again. And next time, with the right technology, it just might stick.